Summer 2025: Don’t Leave It To The Kids

We’ve all heard the story. A savvy investor builds a real estate portfolio over decades—one property at a time. They navigate downturns, push through entitlement battles, renovate, lease, refinance, and through it all, hold onto their portfolio because it works! Wealth accumulates and somewhere along the way they decide that when the time is right, this wonderful real estate portfolio they’ve worked so hard to manage and build will proudly go to the kids.

It sounds noble. Sensible. Familiar. What if that once-reliable strategy is no longer guaranteed to deliver the same outcomes today or even desirable with the next generation?

Not because real estate has lost its relevance but because the assumptions behind generational succession haven’t kept up with the realities of the world, we now live in.

If you’ve spent 20 or 30 years building a portfolio, you know it was anything but passive. You had the benefit of timing, grit, experience, and probably more than a few moments of good luck. Your kids may be intelligent and accomplished but are they ready, willing, and able to manage these assets the way you have? Do they want to? Do they understand the responsibilities, the strategy, the timing of capital improvements, the nuance of tenant relationships, or the quiet risks hiding inside triple-net leases? What about the MOST overlooked question: Do they view “value” the same way you do?

These are not small questions. And yet, they’re rarely asked with the seriousness they deserve. Often, the decision to pass on real estate is made by default. “They’ll figure it out.” Maybe they will. But maybe they’ll fight. Maybe they’ll sell at the wrong time. Maybe the property you preserved for decades will become a liability they don’t know how to handle. These are all very real possibilities.

We’re at a point in the market cycle and the broader economy where default thinking is especially dangerous.

The idea that real estate “always goes up” has been baked into our collective consciousness. It’s been true for so long that we stopped questioning it. But when you zoom out, you start to see that we’ve entered a different phase. If you purchased an asset 20 years ago, it likely appreciated 3–4x. Reality is, it’s unlikely to do that again. The market has now reached maturity and new prospects are on par with or sometimes even superior to the tried-and-true Buy & Hold real estate strategy. Cap rates are tighter. Construction costs are higher. And more importantly, the aging inventory is falling short of modern operational and tenant standards.

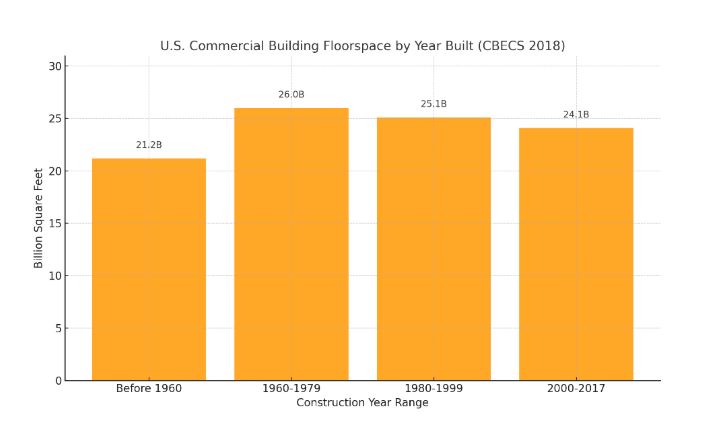

Across the country, about 62% of all commercial real estate—office, industrial, retail, and multifamily—was built before 1990. These properties were constructed in a different economic, regulatory, and technological environment. Many are ill-equipped to meet the expectations of today’s tenants, much less tomorrow’s tenants.

The classic “value-add” strategy—buy a property, do some basic cosmetic changes, hike the rents, and flip it for a nice multiple—is, in most cases, over. What’s coming next is more demanding. Modular space design, integrated energy systems, tenant-specific tech, and creative capital structures such as Bitcoin treasuries and dual-collateralized lending frameworks. These are not abstract concepts. These aren’t theoretical. It’s what will separate the savvy investor from those getting washed out.

And here’s the difficult truth: most of the properties built before 1990 won’t survive this transition. They won’t attract tenants, they won’t achieve “expected” values, they won’t meet lender standards, and they won’t be worth the reinvestment regardless of their basis. We are in the early innings of a long-term recalibration period where not all properties will appreciate and the ones that do may not do so at the same pace or scale we’ve grown accustomed to. This recalibration is not cyclical. It’s secular.

So, the real question is: What are you actually passing down?

A performing asset or a future problem disguised as a legacy? The best case for most is a 6-8% cashflow, a step-up in basis and a few years left on the lease. Not bad for 2005 but how about 2035?

Some will say, “We never sell, we hold our real estate forever!” But holding an aging, depreciating, underutilized asset isn’t a wealth strategy. It’s inertia dressed up as discipline and ignores a reality few want to admit: the conversation about storing value is changing.

For generations, real estate was the default store of value. It was tangible. Income-producing. Hard to replicate. That role is now being challenged, not by another building, but by a protocol. Bitcoin is emerging as a global store of value that requires no maintenance, no tenants, and no taxes. It’s not a replacement for real estate and you’ll still need to be on the lookout for changes in the market, but it is a competing philosophy about what wealth is now and how it should be preserved.

Bitcoin doesn’t age. It doesn’t break. It doesn’t get rezoned, and it’s appreciated at an average compound rate of 60% annually since 2020 and over 80% since 2015. Furthermore, it’s beginning to serve as collateral for real estate acquisitions—replacing traditional fiat liquidity as the capital stack evolves. This is not fringe. It’s the future forming in plain sight and in play today.

This shift is not about abandoning real estate. It’s about recognizing that our assumptions around it, especially generational ones, need to evolve.

If your heirs are educated, aligned, and committed, then maybe leaving them the portfolio makes sense. On the other hand, if they’re uninterested, unprepared, or ideologically disconnected from YOUR strategy, you owe it to them and to yourself to be receptive to a realistic assessment of your present plans using the perspectives of the present and what the future holds for us in this arena.

It might be wise to sell certain assets now, while perceived values are defensible. Consider reallocating toward better-positioned properties. Or even to exit entirely and convert a portion of your wealth into a liquid, transferable, scarce asset that will carry forward with fewer frictions, fewer arguments and fewer assumptions.

In the years ahead, successful real estate operators will need capital discipline, technical fluency, and long-term vision. Those are not inherited traits. They’re learned, earned, practiced but must also have passion to succeed.

The topic of Bitcoin elicits a variety of reactions ranging from curious to downright appalled. Now, a real estate broker is telling you to sell your property, pay Uncle Sam and buy Bitcoin!? Just when you thought the 2020’s couldn’t get any crazier – the goal posts are moved, AGAIN! Well, you have made it this far. You persevered through the downturns, dealt with tenants, somehow got that refi done and resurrected more than one “dead” deal. I think you owe it to yourself and to your heirs to take a closer look at this bitcoin thing so you can make an informed decision, not a default one, about what’s best for all stakeholders and now is the time to be enlightened.

Your real estate legacy should be deliberate, not automatic. The most meaningful thing you can pass on isn’t a building—it’s a framework for stewardship, growth and values.

Don’t leave it to the kids—unless they are ready to build on it and unquestionably share the same passion as you.

In the next edition of CRE Insiders, I will be exploring the topic of dual-collateralized lending products. What are they? The pro’s & con’s. Where to get one and much more!

Previous Editions:

Summer 2024: Real Estate Risks & Opportunities in the Age of Bitcoin

Winter 2023: Commercial Real Estate in an Exponential World

Summer 2023: Future Proof Your Future: Considerations & Strategies in a Transforming Market