Go Green, Grow Your NOI: The Impact of Energy Efficiency on Commercial Real Estate Profits

Is your commercial real estate energy efficient? Did you know that energy usage represents, on average, 33% of your operating costs and is likely to climb in the coming years? Are you doing what you can to use less energy to provide the same service?

As the commercial property market grows more competitive by the day, property owners are constantly searching for new ways to add value to their properties. The good news is that there are numerous ways to trim expenses and the better news is that most apply to a single 5,000 square foot property as much as they do to a million-square-foot portfolio.

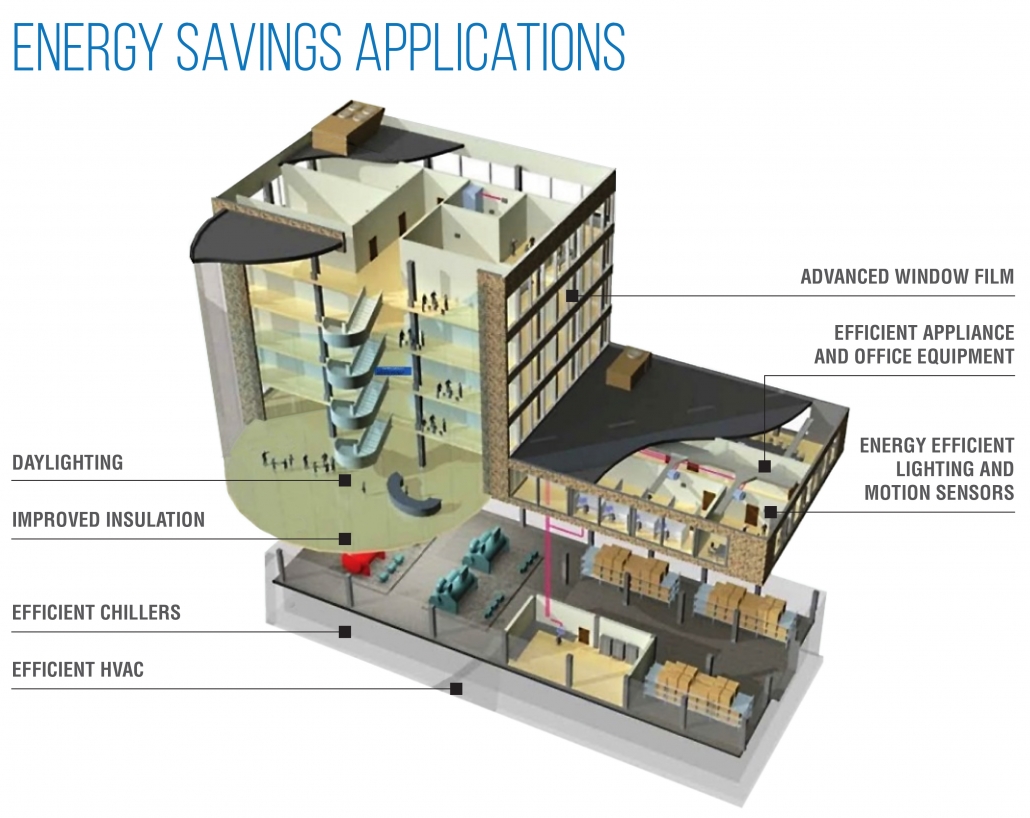

Not every building needs to perform like a trophy asset in Midtown Manhattan, but they should all be optimized to best serve the needs of the most likely mix of tenants. But, one thing is true across all asset types—lighting and HVAC account for up to 71% of energy consumption in commercial buildings. So, it only makes sense to make them the primary focus of an energy efficiency strategy. Some of the most common solutions include:

- Window tint & films

- Bulb and fixture replacement

- Voltage optimization

- Automation of utility usage using a Building Management System (BMS)

- Interior & exterior roof insulation

- Solar power installation

Since utility rates have risen approximately 25% since 2020, professional property owners and managers recognize that in order to remain competitive and increase the value of assets, energy efficiency needs to be on the top of the to-do list. Let’s get down to the numbers.

- Implementing these solutions can result in a 30%-50% monthly cost savings[1]

- ROI averages 6 months, but depending on the building and which solutions are implemented, it could be anywhere from 1 to 24 months.

- Tax incentives and rebates are available at both local and state levels

- Specialized financing is available, up to $5.5MM per building to do “green” improvements[2]

- Energy efficient properties can generate up to a 10% premium on exit sale pricing

There are multiple goals in the practice of sustainability. Increasing NOI by decreasing operating expenses is clearly in the interest of every property owner. Perhaps more important is the fact that delivering a better overall workplace experience for tenants helps them attract and retain the top talent they need to be more successful.

When you increase the energy efficiency of your building, you win, your tenants win and the planet wins, too.

EXAMPLE:

Office Building with Monthly Power Bill of $12,000 (50% is Demand = $6,000)

EE applications installed save minimum of 30% of demand ($6,000*0.30 = $1,800/month)

OR:

30% of 50% = 15% of net Cost Savings every month

Assume, Electric costs on P&L account for 7%